Business Insights: Building a more informed future during preconstruction

Product updates include win-rate analytics, profit tracking, and lost opportunity reporting

Edward Gonzalez

Founder

Imagine transforming your business’s future from a goal achieved through painstaking manual data sifting, endless meetings, and guesswork to a reality shaped by real-time analytics and precise forecasting.

The good news is that the path to greater success has been buried in your project data all along.

Buildr’s enhanced business insights bring unprecedented clarity to the preconstruction phase, empowering your company to answer its most important questions and make more informed decisions with features like:

- Win rate analytics,

- Profit tracking,

- Lost opportunity reporting,

- Annual construction volume statistics,

- Employee project revenue analysis

The future of your business is determined at preconstruction and it’s never been clearer.

Why business insights matter in construction

Data’s primary value is that it’s a guide for action. The construction industry, historically slow in adopting technology, is now embracing data analytics, driven by the rise of popular contech solutions like Autodesk and Procore. But collecting data isn’t enough; its true value emerges when analyzed to inform decisions, demonstrating the ROI of your data collection efforts.

Because collecting data for the sake of collecting data isn’t very useful (see also: spreadsheets).

As an industry, construction stands as the final frontier for data analytics—we’ve noted the industry’s complexity as a hindrance for technology adoption in the past. However, new contech companies are constantly sprouting up to replace outdated hunch-based, “it’s all in my head”-style management with more data-driven strategies.

The old, analog business development methods won’t cut it in the face of hungry, agile competitors who have realized the benefits of leveraging data to increase profits, enhance their reputations, and secure stronger market positions.

Sustained success for general contractors means thriving, not just surviving. Let’s delve into each reporting layer within Buildr and discover why data-informed decisions are essential for your future.

Solidify your go/no-go through win rate analytics

A construction CRM’s true power lies in its ability to enable data-driven decision-making. With win rate analytics, Buildr empowers general contractors to see which jobs they’re consistently winning and why.

A bird’s eye view of win rate data helps answer some of the most important questions for GCs—

- Performance assessment: What types of jobs are we likeliest to win over time so that we can best allocate our estimators’ efforts?

- Go/no-go optimization: What’s the effectiveness of our bidding strategy and overall mindset when it comes to evaluating which projects we decide to pursue?

- Market trend foresight: Which types of jobs or regions are the most profitable for us?

- Competitive analysis: How can we benchmark ourselves against industry standards to help identify areas for improvement and stay competitive?

- Financial forecasting: How can we better pinpoint our future revenue and plan our budgets accordingly?

Since your estimators’ time is so limited, it’s crucial that they’re spending the most time on the opportunities that you’re most likely to win. “Free-con” may be inevitable, but free-con on jobs you don’t end up winning doesn’t have to be.

Understand your financial health and ensure long-term sustainability through profit tracking

With fluctuating input costs, supply chain disruptions, inflation, volatile interest rates, and risk-averse banks, profit pools have never been tighter for general contractors. Annual construction volume doesn’t tell the full story of your business; profit tracking ensures that you’re not only profitable in the short term but on a sustainable path for long-term success.

Identifying which jobs are your bread and butter is crucial in planning your business strategy towards chasing jobs that are the most profitable. Among other things, clarity of your profit margins helps refine your pricing strategy so that you can adjust bid prices based on historical profit data to ensure competitiveness while maintaining profitability.

Understanding the financial health of your business sheds light on a myriad of unknowns including resource allocation, hiring needs, material procurement, technology budget, as well as insights into the viability of expansion into new markets or diversifying your services.

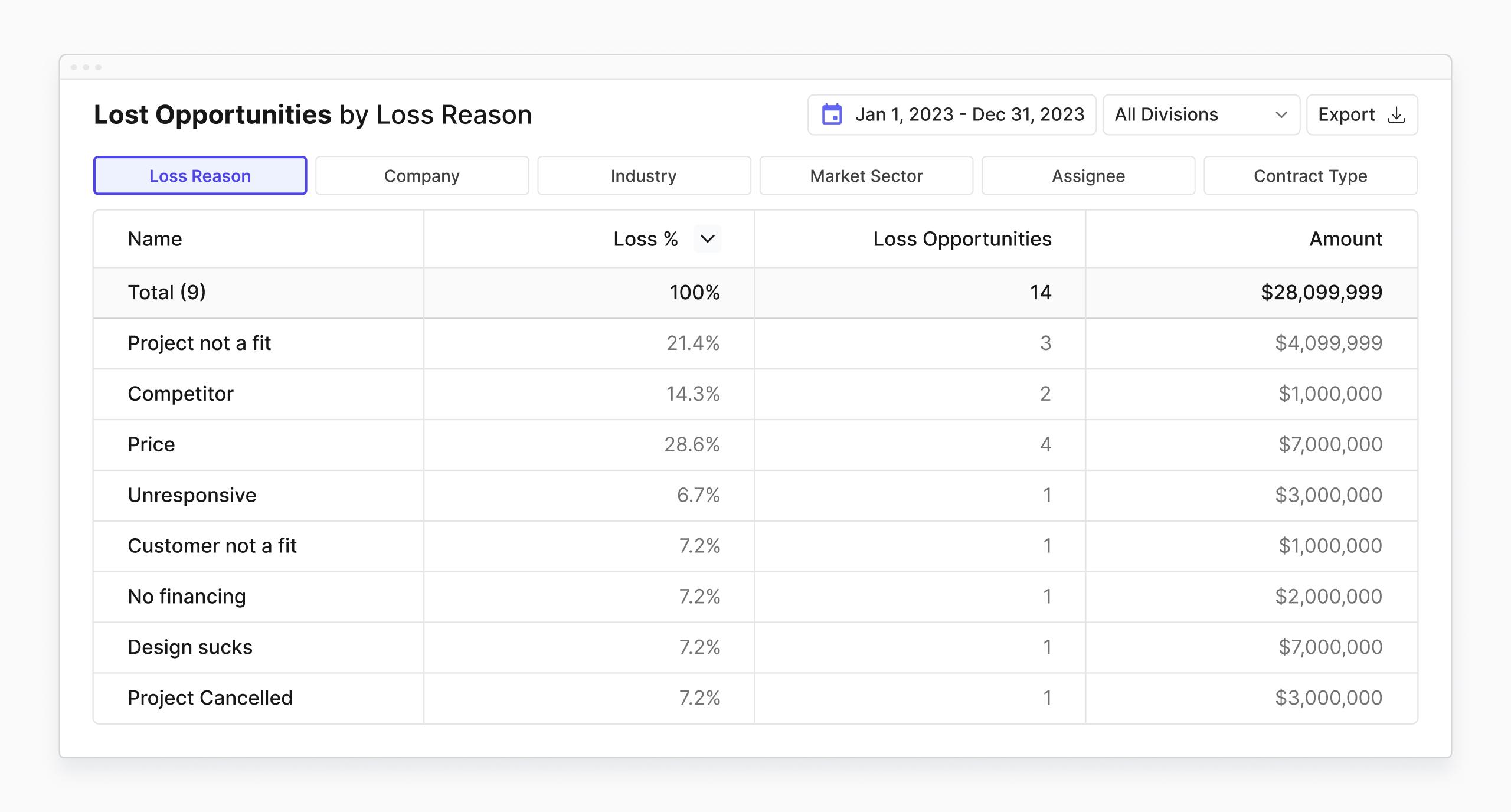

Identify areas for improvement with lost opportunity reporting

Answering your business’s most important questions is integral to achieving the growth you want to hit. Lost opportunity reporting helps you answer many of those questions, like—

- What are the top reasons we lost out on jobs last year?

- Which of our competitors are we most frequently losing to?

- Which aspects of a job can we identify early on so that we can either optimize for that reason or spend energy on jobs we have a higher percent chance of winning?

Similar to learnings gleaned from win-rate and profit data, lost opportunity data primarily helps hone in your business strategy. Understanding why certain projects aren’t won allows general contractors to reconfigure their approach to refine bidding strategy and improve win-rate moving forward.

Lost opportunity reporting also sheds light on resource allocation—if x type of job in y market doesn’t have a high probability of being won because of z reason, you can either:

a) decide to put effort toward optimizing for z, or

b) forget x and allocate resources to jobs that have a higher chance of success.

Decide your pace of growth with annual construction volume statistics

Comparing your annualized construction volume year-over-year helps you benchmark performance against previous years while adhering to a preferred trajectory of growth.

When prompted, nearly every GC knows their ACV without having to look it up—or at least the ballpark number of this year vs. last year’s. But the ability to pull up all historical ACV data is profound, not only in understanding how you got here but how the future can be better mapped.

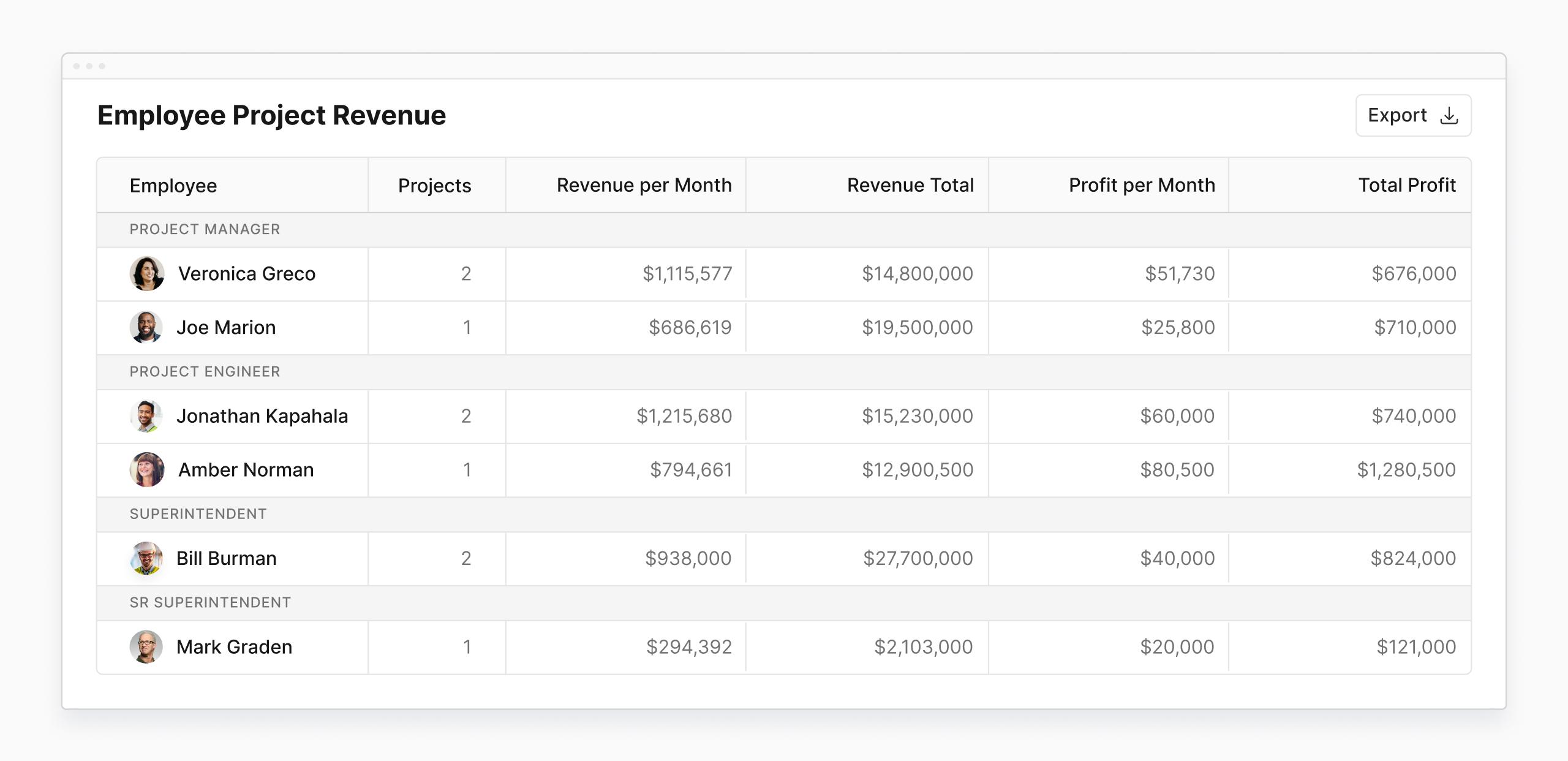

Higher workforce intelligence with employee project revenue analysis

- Which of my team members are the MVPs in profit coming in?

- If we want to optimize for profit, who should we staff on this elementary school job?

- Which team members deserve promotions and which could use more training and development?

- If we hired 5 new team members, what revenue could we expect to bring in?

Understanding the profit contribution of individual employees informs workforce, salary, and hiring strategy. Knowing which employees generate the most profit can guide more effective resource allocation on jobs that make the most sense for your high performers.

Knowing exact revenue per employee also informs your budget with regards to salary—are we paying Jim a number in line with the amount of profit they’re actually contributing to the business? The trickle down effect continues as all of this intelligence informs future hiring plans.

A clearer path forward with business insights within your preconstruction process

The many moving parts of the preconstruction engine necessitates a heightened level of accessibility and centralization of data, which is one of the reasons why Buildr’s unlimited seat model makes sense for so many builders. To learn more about the ways in which Buildr unsilos preconstruction teams, read our product blog Introducing: Buildr Collaboration.

Automated reporting from integrated data within your CRM means you no longer need to manually locate and create reports from raw data, saving you the hassle of finding every meaningful column of information in every Excel sheet floating around your business (and worst of all repeating the process making sure to include the data that’s been captured since the last time).

The best part is that you don’t have to wait for insights just because you just implemented Buildr. We work with our clients to upload historical data from your previous CRM or spreadsheets so that you can start receiving actionable insights as soon as possible.

According to our clients, we’ve found that the effort in manually created reports disincentivizes looking at data at all, meaning less informed decision-making, more gut decisions, and more hunches. At Buildr, we’re in the business of getting rid of those. See a demo today.